The banking sector faces unprecedented challenges. We help you overcome the barriers that limit your sales performance.

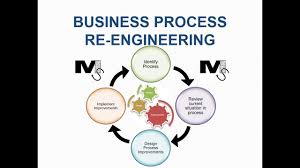

Sales Process Reengineering

Align sales stages with the buyer journey for optimal conversion rates and customer experience.

Transform your commercial banking sales performance with measurable outcomes that drive sustainable growth.

01

02

03

04

05

06

Our sales consulting services are tailored for different commercial banking sub-sectors.

Corporate Banking

Comprehensive banking solutions for corporations

We help corporate banking institutions sharpen their customer targeting and solution positioning across offerings like:

Investment Banking

Strategic financial advisory and capital solutions

For Investment Banking firms, we strengthen the deal origination engine and help enhance consultative selling for:

The banking sector faces unprecedented challenges. We help you overcome the barriers that limit your sales performance.

Struggling to articulate unique value to enterprise customers in a commoditized market.

Underperforming client acquisition and relationship management teams across branches.

Wide performance gaps across branches, relationship managers, and customer segments.

Difficulties in cross-selling and upselling financial products to enterprise customers.

Extended sales cycles and declining proposal win rates impacting revenue growth.

Wide performance gaps across branches, relationship managers, and customer segments.

We diagnose gaps in your current sales setup, identify capability and performance limitations, and co-create solutions that align your sales strategy, structure, skills, and systems with your business goals.

Align sales stages with the buyer journey for optimal conversion rates and customer experience.

Equip bankers with advanced skills to advise, influence, and convert prospects into clients.

Focus on high-potential segments with personalized strategies and tailored approaches.

Comprehensive playbooks, pitch decks, value calculators, and ROI models for every scenario.

IT sales teams often face long buying cycles,a Commonmartin Consulting helps banks overcome issues like ineffective value propositions, low productivity among client acquisition teams, inconsistent performance across branches, difficulties in cross-selling and upselling, extended deal cycles, and declining proposal win rates. multiple decision-makers, pricing pressure, low conversion rates, and unpredictable pipelines. Many also struggle with value-based selling and underutilized account potential.

Commonmartin offers a hands-on, practical approach. They don’t just provide recommendations; they work alongside your team to implement strategies, ensuring measurable improvements in sales performance and sustainable growth.

Expected benefits:

Commonmartin’s performance transformation on an average:

Commonmartin tailors its services for various banking sectors, including: